Nvidia, the powerhouse of AI and semiconductor innovation, delivered a blockbuster report for its second quarter earnings late Wednesday, surpassing both revenue and profit estimates and setting a bullish outlook that surprised Wall Street yet again.

In its fiscal second quarter, Nvidia announced adjusted earnings per share of $0.68 on a staggering $30 billion in revenue. Analysts had projected $0.64 EPS and $28.8 billion in revenue, making Nvidia’s performance a breathtaking 122% leap in revenue from the previous year, with earnings skyrocketing by 168%. For the upcoming third quarter, Nvidia forecasted revenues around $32.5 billion, plus or minus 2%, higher than the anticipated $31.9 billion.

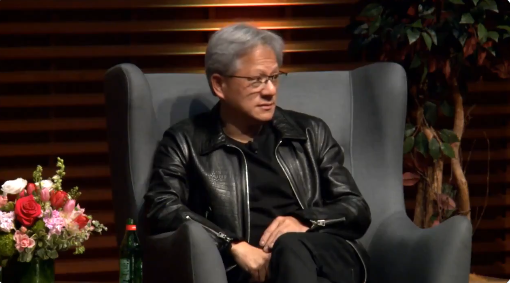

Nvidia CEO shows off $40,000 chip

— Past To Present Stories (@past2present_x) August 28, 2024

However, despite these dazzling figures, Nvidia’s shares fell by about 3% in pre-market trading on Thursday, with a sharper dip of 6% immediately following the earnings release. This reaction underscores the volatile nature of investor expectations in a market that is perpetually looking for the next big leap forward.

The engine driving Nvidia’s exceptional growth remains its data center business, which generated $26.3 billion in revenue this quarter, easily outpacing the $25 billion predicted by analysts. This represents an extraordinary 154% increase from the same quarter last year when the segment brought in $10.3 billion, highlighting the explosive demand for Nvidia’s AI hardware and software solutions.

CEO Jensen Huang, commenting on the company’s momentum, emphasized the overwhelming anticipation for Nvidia’s next-generation Blackwell chip, calling the excitement “remarkable.” Meanwhile, CFO Colette Kress outlined plans for Blackwell’s production ramp-up in the fourth quarter, extending into fiscal 2026, with several billion dollars in revenue expected from these shipments. She also noted modifications made to the Blackwell GPU design to optimize manufacturing yields, underscoring Nvidia’s relentless push for efficiency and innovation.

🚨 NVIDIA CEO GIFTS ELON A DGX-1 SUPERCOMPUTER FOR OPENAI

In 2016, Nvidia CEO Jen-Hsun Huang presented Elon with a DGX-1 supercomputer, gifted to Elon’s AI research non-profit, OpenAI.

Nvidia called it “the world’s first supercomputer dedicated to artificial intelligence.”… pic.twitter.com/efaWs3tcJB

— Mario Nawfal (@MarioNawfal) August 29, 2024

Beyond the current offerings, Nvidia also announced a massive $50 billion expansion of its share repurchase program, adding to the $7.5 billion still available from its existing buyback authorization as of the quarter’s end. This move reflects Nvidia’s robust cash flow and commitment to returning capital to shareholders amid its booming business.

While the data center continues to be the star performer, Nvidia’s gaming division also saw growth, with revenues reaching $2.8 billion, a 16% increase from the prior year. Though no longer the core driver of Nvidia’s financial success, the gaming segment remains a crucial component of its diversified portfolio, providing steady returns alongside its rapidly expanding AI endeavors.

Nvidia’s dominance in the AI chip sector is almost unchallenged, holding between 80% and 95% market share according to industry estimates. Its leadership is further bolstered by deep partnerships with tech giants like Microsoft, Amazon, Google, and Meta, which rely heavily on Nvidia’s technology to power their AI initiatives, making Nvidia not just a supplier but a strategic partner in the AI revolution.

Nvidia CEO: “you cannot show me a task that is beneath me.”

The enemy of continuous growth is arrogance, zero sum mindset and a sense of entitlement. pic.twitter.com/VeTAuCSmWU

— Vala Afshar (@ValaAfshar) August 28, 2024

Meanwhile, competitors such as AMD are making strategic moves to challenge Nvidia’s supremacy. AMD’s recent acquisition of ZT Systems for $4.9 billion aims to bolster its capabilities in the AI server market, a key area of growth that has fueled Nvidia’s own expansion. However, this acquisition is unlikely to dislodge Nvidia from its dominant position any time soon.

“There are emerging competitors like AMD that are starting to nibble at the edges,” Stifel managing director Ruben Roy noted to Yahoo Finance, “but when you consider the full scope of the infrastructure build-out in AI, Nvidia still stands head and shoulders above the rest in terms of its strategic positioning and capability to capitalize on this monumental shift.”

Major Points

- Nvidia reports $0.68 EPS on $30 billion revenue, beating estimates.

- Revenue up 122% from last year; earnings soar 168%.

- Data center revenue hits $26.3 billion, up 154% year-over-year.

- Nvidia announces $50 billion share buyback expansion.

- Despite strong results, Nvidia shares drop 3% in pre-market trading.

TL Holcomb – Reprinted with permission of Whatfinger News